No matter if you’re a monetary advisor, investment issuer, or other economical Experienced, investigate how SDIRAs could become a robust asset to increase your enterprise and accomplish your Expert ambitions.

As soon as you’ve uncovered an SDIRA service provider and opened your account, you may be pondering how to truly start off investing. Knowledge both of those The principles that govern SDIRAs, and ways to fund your account, can help to put the inspiration for just a way forward for prosperous investing.

Increased Fees: SDIRAs usually feature higher administrative fees compared to other IRAs, as specific facets of the executive system can not be automatic.

And since some SDIRAs including self-directed traditional IRAs are subject matter to needed minimum amount distributions (RMDs), you’ll must approach ahead to ensure that you may have sufficient liquidity to meet The foundations established because of the IRS.

The tax benefits are what make SDIRAs attractive For lots of. An SDIRA is often the two conventional or Roth - the account type you decide on will depend mainly in your investment and tax technique. Examine with the money advisor or tax advisor for those who’re Doubtful which is best for you.

Have the freedom to speculate in Just about any kind of asset using a threat profile that fits your investment system; together with assets which have the possible for the next fee of return.

Creating quite possibly the most of tax-advantaged accounts permits you to continue to keep a lot more of The cash that you make investments and gain. Based on no matter if you end up picking a standard self-directed IRA or a self-directed Roth IRA, you've got the probable for tax-free or tax-deferred development, furnished certain circumstances are satisfied.

IRAs held at banking institutions and brokerage firms supply constrained investment alternatives to their customers since they do not have the expertise or infrastructure to administer alternative assets.

No, You can't invest in your individual enterprise which has a self-directed IRA. The IRS prohibits any transactions among your IRA plus your very own business enterprise since you, as being the operator, are deemed a disqualified man or woman.

An SDIRA custodian is different simply because they have the suitable personnel, experience, and capability to keep up custody from the alternative investments. The first step in opening a self-directed IRA is to find a provider which is specialized in administering accounts for alternative investments.

Confined Liquidity: A lot of the alternative assets that could be held in an SDIRA, such as housing, personal equity, or precious metals, will not be effortlessly liquidated. This may be an issue if you need to accessibility resources speedily.

Better investment options usually means it is possible to diversify your portfolio past shares, bonds, and mutual resources and hedge your portfolio towards sector fluctuations and volatility.

Lots of buyers are astonished to master that applying retirement resources to take a position in alternative assets has actually been probable considering that 1974. However, most her explanation brokerage firms and banking institutions deal with supplying publicly traded securities, like shares and bonds, since visit their website they absence the infrastructure and abilities to manage privately held assets, including real estate property or non-public fairness.

Be in control of how you increase your retirement portfolio by utilizing your specialised awareness and pursuits to speculate in assets that match along with your values. Obtained know-how in housing or personal equity? Utilize it to help your retirement planning.

Complexity and Responsibility: Having an SDIRA, you may have a lot more Manage around your investments, but You furthermore mght bear a lot more obligation.

SDIRAs in many cases are used by hands-on traders that are ready to take on the risks and obligations of selecting and vetting their investments. Self directed IRA accounts can be perfect for traders who may have specialized information in a niche market which they wish to invest in.

Homework: It is identified as "self-directed" for a cause. Having an SDIRA, you're totally chargeable for completely exploring and vetting investments.

Entrust can aid you in getting alternative investments using your retirement cash, and administer the acquiring and offering of assets that are typically unavailable via banks and brokerage firms.

Criminals occasionally prey on SDIRA holders; encouraging them to open up accounts for the purpose of Retirement asset protection companies creating fraudulent investments. They often fool buyers by telling them that In case the investment is accepted by a self-directed IRA custodian, it need to be genuine, which isn’t true. Once again, make sure to do extensive homework on all investments you select.

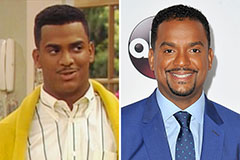

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!